portability estate tax definition

Portabilitys Effect on Tax-Efficient Estate Tax Planning. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

2660000 taxable estate x 40.

. However that exemption is scheduled to. In other words if your assets are worth 112. Entries for the gross estate in the US the taxable.

The portability election is made. The federal estate tax law was amended in 2013 to permit the executor of the estate of the first deceased spouse to give any unused unified credit to the surviving spouse. In this example that is nearly 8 million.

The estate tax portability rules save your estate from almost being cut in half when sent to your heirs. Portability Estate Tax Definition. The current estate tax exemption is.

When computing the DSUE amount Code Sec. The exemption is in fact indexed annually for inflation so it does increase over time. Normally you have 9.

Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. 2022-32 may seek relief under Regulations section. As of 2021 the federal estate tax exemption is 114 million.

The exemption is subtracted from the value of estate assets with the result being subject to the estate tax. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. The exemption is subtracted.

Attach a statement to the return that refers to the particular treaty applicable to the estate and write that the estate is claiming its benefits. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within. 2010 c 4 refers to the amount with respect to which the tentative tax is determined under Code Sec.

The non-exempted amount of 545 million would be portable and would be passed to his wife. 2001 b 1 on the. The key is to file for estate tax portability on time.

Without portability they will pay taxes on the difference between the value of your estate and the current estate tax exemption. Thus Jennifers estate will owe about 1064000 in estate taxes after her death. As of January 1 2018 the estate tax exemption for individuals is 112 million adjusted for inflation.

Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev. Estate tax portability means that the unused portion of the first-to-die spouses estate tax exemption passes to the surviving spouse. 8000000 estate 5340000 exemption 2660000 taxable estate.

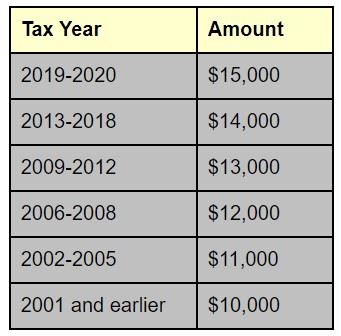

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. What is estate tax portability.

The Estate Tax is a tax on your right to transfer property at your death. Currently the federal estate tax exemption is 11400000 per spouse. Portability is the ability to move a certain amount of money that can be left to others tax-free for estate planning purposes as.

Distributable Net Income Tax Rules For Bypass Trusts

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Deceased Spousal Unused Exclusion Dsue Portability

Form 706 Extension For Portability Under Rev Proc 2017 34

Tax Exemption Portability Crucial In Estate Planning Spindler And Associates

What Is Portability Burner Law Group

What Spouses Need To Know About Portability Of The Estate Tax Exemption

Exploring The Estate Tax Part 1 Journal Of Accountancy

Estate Planning With Portability In Mind Part Ii The Florida Bar

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Advanced Estate Planning Ppt Download

How Portability Dsue For Estate And Gift Taxes Could Save You Millions No Really Atticus Magazine

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Recent Developments In Estate Planning Part I

The Wealthy Now Have More Time To Avoid Estate Taxes

:max_bytes(150000):strip_icc()/IRSForm706_2021-aee03bee297748d9988a86adeaf889cf.jpg)